COVID-19 – Immediate Impacts on Accounting and Financial Reporting

The ongoing COVID-19 pandemic is deeply affecting everyone’s day to day lives. As a result, this is also affecting virtually all businesses and their normal daily operations. The accounting and financial reporting processes are two viable aspects of your business which must maintain their effectiveness in order to maintain financial stability. The pandemic may have short and long term impacts on your financial statements, as well as the internal controls over financial reporting which have been put in place.

Listed below are some of the accounting issues which you and your business should be analyzing and which could potentially be affected by the pandemic:

- Management estimates

- Estimates are often based on management’s judgments and various inputs. These, of course, can be changing now due to changes in the current environment

- Long term assets and intangibles

- There could be impairment or asset recoverability issues that could affect the carrying value of these types of assets

- Fair value

- Just like estimates, fair value guidance is often based on judgments and inputs, as well as the general economy and marketplace

- Liabilities

- There could be potential modification and extinguishment of liabilities issues to address in the near term. Also, extensions for providing financial statements to lenders and loan covenants may need to be discussed

- Revenue recognition

- Variable consideration and collectability might be issues that have to be analyzed in light of your customers being affected by the pandemic

- Lease accounting

- Just like revenue, there could be collectability issues in regards to lease payments. In addition, lease agreements could be amended or replaced

- Risk and uncertainties, as well as going concern

- Entities need to analyze how the pandemic could affect their business, cash flows, etc. in the long term

- Subsequent event disclosures

- All of these factors could play a role in your current financial statement disclosures

More importantly, your internal controls, particularly those controls over financial reporting, are being affected. Here are some issues which you may be facing in regards to internal controls:

- Segregation of duties

- Key personnel might not be able to effectively execute the controls originally implemented

- Key information

- Information might not be flowing as smoothly and accurately as it did previously

- Remote work

- Are there data recovery and disaster plans in place

- Does the entity have the proper technology in place in order to properly operate in a remote workplace

- Communication – are there programs in place to ensure communication is apparent throughout your team. I.e. Microsoft Teams, Skype, etc.

- Communications with third parties

- Have you been in close contact with your CPA, attorneys, insurance brokers, bankers, as well as others who play an important role in your overall business

- Are data communications with third parties being done so in a secure environment

- Financial statement closing

- All of these issues will be affecting your financial statement closing process and ability to produce accurate, timely financial information

In addition, some other accounting relates issues you should be thinking about are:

- How do I address cash flow issues in the future?

- What kind of relief is available?

- What is customer demand of my goods or services going to look like?

- What is going to be the availability of goods or materials needed? Is there an alternative source? And if so, is there any additional cost or risk associated with such?

These are just some of the areas you should be thinking about now in terms of your accounting, financial statement and internal control processes. Reach out to us so that we can help assist you and your business navigate through these truly unprecedented times.

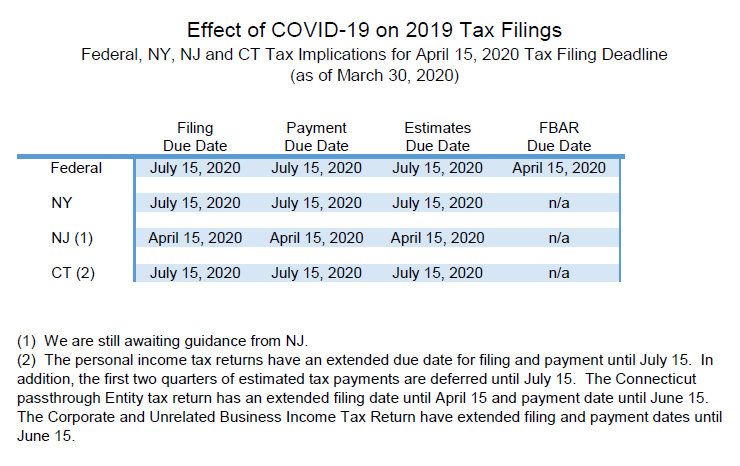

Effect of COVID-19 on 2019 Tax Filings

The IRS has provided guidance for income tax returns due on April 15. The due date is extended until July 15 for individual, corporation, trust and estate income tax returns. The payment date is also extended for these returns. Any payments deferred until July 15 will not be subject to any interest and penalty charges. This rule also applies to the 4/15 quarterly estimated tax payment. If you cannot file your 2019 income tax return by July 15, 2020, then you can file an extension by July 15, 2020 and pay any amount due at that time. If you owe any money after July 15, 2020, then interest and penalties will apply after that date.

The IRS addressed the following questions:

- The second quarter that is due June 15, 2020 hasn’t been extended to July 15, 2020.

- Gift and estate tax returns haven’t been extended to July 15, 2020.

- Any claim for refunds for 2016 haven’t been extended.

- Forms 706, Estate Tax Returns have due dates that are contingent upon the death of the taxpayer. The IRS Guidance issued does not any extend these returns or returns with extended due dates.

- The change in the filing dates and payment dates are not applicable to fiscal C Corp returns or 990s due May 15 or June 15.

Unfortunately, the IRS has not yet addressed:

- Information returns such as FBARs have also not yet been addressed. Therefore the FBAR apparently is still due April 15 but practically is automatically extended till Oct 15.

- 5500-EZ returns are normally due July 31. Typically, if the underlying 1040 is extended, the 5500-EZ due date is similarly extended till Oct 15. Absent any guidance, an extension for form 5500-EZ may need to be filed before July 31, 2020.

The States have not been uniform in their approach as shown in the grid below.

We will be updating this memo as the IRS and the States provide additional guidance.

Updated Guidance on Deferring Tax Payments and Mortgage Payments Due to the COVID-19 Outbreak

On Tuesday March 17, 2020, the Secretary of the Treasury, Steve Mnuchin, announced that there will be a 90 day interest and penalty free extension of time for certain taxpayers to pay all or part of their Federal income taxes beyond the normal April 15th deadline.

This was followed the next day by Internal Revenue Service Notice 2020-17, which provided some much needed clarity to this broad statement.

The Notice defines an Affected Taxpayer as “any person with a Federal income tax payment due April 15, 2020.” The relief provides that for taxpayers other than C Corporations (i.e. individuals), payments of up to $1,000,000 can be postponed until July 15, 2020 with no interest or penalty charge during that postponement period. In the case of each C Corporation or a consolidated group of corporations, the maximum amount that can be postponed is $ 10,000,000.

The notice makes it clear that this only applies to payments due on April 15, 2020, which includes any required first quarter 2020 estimated tax payment, and the above mentioned dollar limitations are aggregate amounts for each taxpayer. It is also clear that this only covers Federal income tax (including self-employment tax), and that this is not an extension of time to file any tax return or extension on a timely basis.

At this point, it is not clear whether any or all of the states will grant similar deferrals of payment or if any will allow blanket extensions of time to file.

Note that this does not provide any relief for the second quarter estimated tax payment due June 15th, nor to certain ex-pats or non-resident aliens that have a filing and payment due date of June 15th.

Additionally, banks in New York will waive mortgage payments for 90 days and suspend foreclosures, Gov. Andrew Cuomo said on Thursday, March 19, 2020.

Eligibility for waived payments is based on financial hardship, the Governor said. The 90 days constitutes a grace period. For those individuals who participate in this program, they will still owe their payments but be allowed to pay them at a later date.

The Janover Tax Practice Group will continue to monitor the situation and will provide updates as more information becomes available.

As always, please reach out to us with any questions or if you need any additional assistance during these most unusual times.