Automate Your Tax Return Process

Janover has partnered with SafeSend Returns to deliver your essential tax documents directly to your email, no paper documents or post office visits required. Sign up for SafeSend Returns to review and sign your personal, fiduciary and business income tax returns, save your tax documents for your records and easily forward your tax documents to your financial advisors.

How to Use SafeSend Returns

Getting Started with SafeSend Returns

Janover leverages SafeSend Returns to securely deliver tax returns to our clients. The process for accessing and reviewing your documents is simple:

- When your tax return is complete, you will receive an email from noreply@safesendreturns.com containing a link to your tax return. You will see “Janover, LLC” in the subject line.

- Authenticate your account by entering the last four digits of your Social Security number and confirming your unique access code when prompted. The access code will be delivered in a separate email.

- You can now view, sign and save final tax returns for your records or make payments.

- Confirm E-mail

- Review Documents

- Electronically Sign Returns

- Make a Payment

Frequently Asked Questions

Yes. Client data is encrypted by SafeSend and stored on secure servers managed by their parent company, cPaperless.

You will create your SafeSend Returns account once your tax return is ready. You will receive an invitation email from noreply@safesendreturns.com with “Janover LLC” in the subject line instructing you to enter the last four digits of your social security number and unique access code (emailed in a separate email). After authenticating your account, you will have access to your documents.

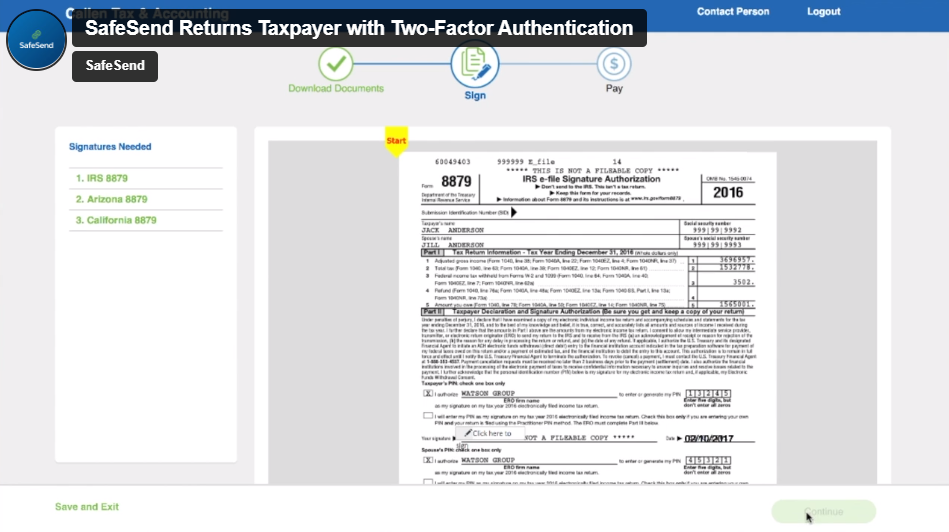

Once you have signed into your SafeSend Returns account, you will see a dashboard with the options to Download Tax Documents, Sign Forms or Make a Payment. To sign your documents, follow these steps:

- Click the green “Let’s Get Started” button to download your documents and sign your forms.

- After downloading your documents, enter your date of birth and confirm your consent to e-sign. If you are filing jointly, you can add the email address of your spouse on this page. Your spouse will sign the forms separately.

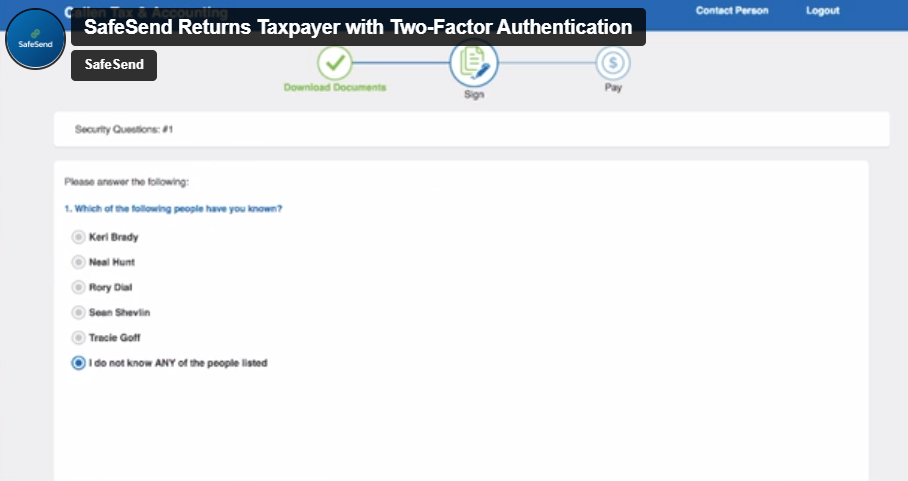

- Answer the knowledge-based questions pulled from government and credit sources that appear on the screen.

- You will now see your return. Click the yellow “Start” button in the top left-hand corner of the document. The software will direct you to the appropriate places for you to e-sign.

- Once all signature spaces are e-signed, a yellow “Finish” button will appear above the green “Continue” button in the bottom right-hand corner of the page. Click “Continue” to complete the signing process.

After you sign your documents, you will be taken to the payment page where you can complete your payments:

- On the payment page, you will be able to review and pay your federal and state taxes.

- Click the icon for the payment you would like to make. This will take you to a link to make these payments directly.

- You can also download all of your payment vouchers for your records from the payment page.

- If you do not wish to pay at this time, you will be able to send email reminders to yourself to pay at a later date.

Janover uses SafeSend Returns for individual (1040), trust (1041) and business returns (1065, 1120 and 1120-S). Gift tax (709), estate tax (706) and non-profit (990) tax forms are currently not supported by SafeSend Returns, but can be e-signed via SafeSend Signatures. Please reach out to your tax professional for more information.

SafeSend Returns will store your information for seven years. Be sure to manually save all documents for your records.

SafeSend Returns provides a link for you to make your payment digitally. If you prefer to mail in your payment, you can do so by printing your payment vouchers from the payment page.

It is easiest to e-sign your documents. After this is complete, your documents will go back to your tax professional who will complete the document and submit to IRS (opposed to e-filing directly with the IRS). You do, however, have the option to print, sign and return your documents directly to your tax professional if you wish.

If you and your spouse file jointly, you will both need to sign your forms individually. You may do this two ways:

- If you and your spouse’s email addresses are both on file, you will receive separate invitation emails to SafeSend Returns. You will both complete this process individually.

- If only your email address is on file, you will have the option to add your spouse’s email address so they may set up an account.

This process can be completed on a smartphone, tablet or desktop computer. Note that you will not be able to download a zip file to your smartphone.

If you need additional support, see the information below:

- Call SafeSend Support at 855-818-3552

- Report an issue on the SafeSend website

- See SafeSend Returns Troubleshooting help page

- Contact your tax professional directly